About 'forex gold'|Forex Activity & Gold

Managing assets may need to adapt to changes but there are universal principals set out in these 10 tips for asset allocation: 1 Goals 2 Professional advice 3 Needs, wants 4 Timing for asset allocation 5 Debt management 6 Financial planning with extended family members 7 Investment vehicles 8 Estate planning 9 Insurance 10 Enjoyment 1 Goal Setting The goal for every family - whether an individual or family with several special needs children - should include a goal of allocating resources to build assets. Laying out your financial present circumstances and building to a longer-term horizon depends on the situation your family faces. We have four children, one guardian and a granddaughter. Two of our children will need long term care due to mental and emotional disabilities. Our goals are clear to us: saving for retirement, long-term planning for our children, learning about specific investments such as real estate, vacation planning, education, and career possibilities. We also try to look at what we need and want around the house and budget carefully so those expenses don't drain our immediate cash flow. Planning, or at least discussion, with our siblings regarding any long term care needs of our parents is also a topic to cover. Trying to anticipate present circumstances and future events will impact decisions for short-term, middle-term and long-range planning. 2 Professional Advice Find someone who is trustworthy, comes across honest and who is passionate about helping others financially. Most financial planners spend their time with high net worth individuals and, if they're with an established firm, will cut out the smaller net worth accounts to maximize their own time and income. Interview someone who has your best interest at heart and can help you plan to meet future goals regardless of your current financial status. 3 Needs, Wants We just spent about $ 700 building a retaining wall, patio and pathway in our backyard. Income has been tight the last few months yet we felt this expense was worthwhile to finally have an area of the yard after 14 years that's set apart from our house. Try to anticipate important needs for the next 1 - 5 years and plan on meeting those. Keep impulse purchases to a minimum. 4 Timing for Asset Allocation Take time to plan for short-term, middle term, and longer-term income and expense needs. Securing an income for the next 1 - 3 years is actually more important than retirement planning since we established that habit and pattern starting in our 20s. We know we'll need another car in about 2 - 5 years so having assets on hand to cover an expense will be necessary. 5 Debt Management Common sense can play an important role here. High interest debt is bad - get rid of it as aggressively as possible. Managing debt related to appreciating assets such as a home can be worthwhile. Now here's a question: should you pay down your home mortgage with extra principal payments or invest the difference? The answer will be individualized according to an individual's financial discipline and size of the mortgage. I believe in any asset you own, whether a house or car, work to keep your equity portion at 70% and the debt servicing at 30%. 6 Financial planning with extended family members For those of us in our 40s and 50s, we are faced with expenses related to growing children and the possibilities related to aging parents. Does your parent or do your parents have an estate plan? If not, talk to them about the wisdom of spending $ 2,500 to $ 3,500 for a lawyer to draft a plan. The cost of long term care insurance may be worthwhile and delicately bringing up the issue of retirement communities should be done tactfully. For children entering their teens, paying for college should be discussed with them. Give them some ownership of the issue - whether it's earning through partial scholarships or summer jobs. 7 Investment vehicles Mutual funds, individual stocks, real estate, annuities and finally commodities such as gold can help build a solid portfolio. Mutual funds are perhaps the wisest investment due to their diversification and liquidity. The rule of thumb: invest in secure assets. A common question investors ask is should they own mutual funds or specific stocks. Writing in Physician's Digest May 2006, Carrie Coghill, CFP, writes "The biggest advantage to owning individual securities versus mutual funds is the flexibility to buy and sell securities in a manner that is suitable to your specific tax situation." In other words, mutual funds pass along gains but not losses to write off. But the loss of one individual stock can offset the taxable gain of another. However, if I find myself in a position to pay taxes due to capital gains I consider that a good problem to have! Have you heard about FOREX (Foreign Exchange). Have fun learning it about on free demo platforms and only trade money you decide to use for speculative investments and you don't care if you lose it or gain a return. It's not an asset. Another investment vehicle to consider are low-budget, independent films. Again, don't expect a return. However, a production company I know is producing a low-budget feature that has a strong chance of profiting from distribution. A low budget with a good storyline distributed with today's digital platforms stand a good chance of positive returns. 8 Estate Planning Don't sit down to write a will. Interview law firms and take recommendations to lay out a total estate plan. If you donate to a non-profit, then the organization should have an attorney willing to help you allocate your overall assets. We have 2 children in their late teens and early 20s who won't be able to live independently. While they have state funding available to them, carefully detailing how we want our assets used to support them is necessary. Major banks may also have specific personnel who specialize in estate planning, too. 9 Insurance Insurance is a way to guard against catastrophic events. I heard an insurance agent explain the benefits of an umbrella policy to protect all assets. That may be one of the best ways to go. Here's how he explained it to me, a person who carries only liability insurance on our cars. "You're driving on the freeway, an accident occurs and the person you hit is severely injured or even dies. Is liability insurance going to cover the claims they're going to file? Look at how houses have appreciated in Southern California. That can be equity for the taking." That was about 3 years ago when he explained umbrella coverage to me. I haven't done anything yet, but it lurks in the back of my mind. Have enough insurance for the protection you need. 10 Enjoyment Money should be earned to work for us and not against us. Allocate money each year for at least a small vacation or time of fun. Perhaps a nicer vacation once every two to three years will be suitable for your family. In some cases, saving up for a nice vacation or special fun time could be a family project. Does owning a time share make sense? Today's programs giving flexibility to owners may make sense. If you go to a presentation, try to do research ahead of time on the best companies because, yes, you'll be asked to buy then. Then stop to periodically assess your financial situation and if your goals are being met. This way, you gain control over your money and circumstances instead of feeling controlled. That equates to financial freedom. |

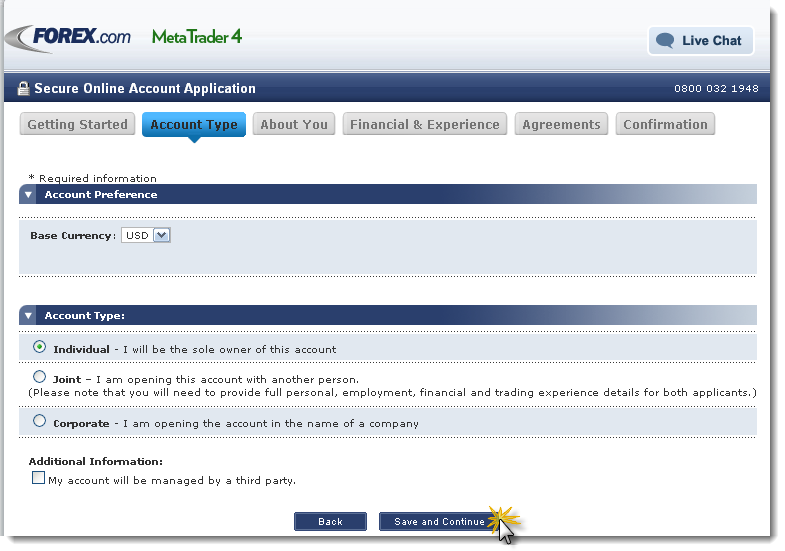

Image of forex gold

forex gold Image 1

forex gold Image 2

forex gold Image 3

forex gold Image 4

forex gold Image 5

Related blog with forex gold

- fofoa.blogspot.com/... "majority-owned" by gold trading as an electronic FOREX currency, which has almost... additional incentive to short FOREX "gold" around May of this year. It ...

- my4xblog.blogspot.com/Product Name : Forex Gold Trader 4.0 Website Address : www.forexgoldtrader.com Product... Price : $99.00 Visit Official Website Here Forex Gold Trader 4.0 top features : Stable Performance...

- duyduyfx.blogspot.com/One of my blog reader recommend me to to test "Forex Gold Trader EA" Forex Gold Trader Ea is for Gold and Silver only that take advantage of...

- forexnurabbas.blogspot.com/... and tested by the Best Forex Reviewer & Tester on the net! #6. FOREX GOLD TRADER V.2.0 RUNNING ON $45.000 REAL ACCOUNT!!! BACKTEST RESULTS (4 ...

- duyduyfx.blogspot.com/One of my blog reader recommend me to to test "Forex Gold Trader EA" Forex Gold Trader Ea is for Gold and Silver only that take advantage of...

- goldheaven.blogspot.com/GOLD/SILVER FOREX: Pelaburan Minima bagi membuka trading...dari USD150 cas sebanyak USD50 akan dikenakan. Margin & SPREAD GOLD Margin 0.50% spread 60 pips SILVER Margin 2.00...

- forexstrading.blogspot.com/... in the central banks. Happy New Year! If you have want to comment on this Forex / gold/oil/interest rates forecast for the year 2011, please, feel free to reply using...

- spyfrat.wordpress.com/Forex Activity & Gold March 12, 2009 As the dollar weakens, Gold...Entry filed under: Uncategorized . Tags: forex , gold , gold dollar corelation .

- fundamentalforex.wordpress.com/Forex – Spot Gold Forex – Spot Gold Podczas wczorajszych porannych godzin handlowych złoto było...... February 13, 2011 - Posted by forexnovini | Forex - Spot Gold | Forex , USD

- funnyforex.wordpress.com/Forex – Spot Gold Forex – Spot Gold During the trading hours yesterday, the spot...Be the first to like this. January 7, 2011 - Posted by deputatite | Gold | Forex , spot gold

Forex Gold - Blog Homepage Results

The markets have rallied just as expected. There still seems room for more upside. Im taking this opportunity to sell into strength and taking profits off my SPY calls.

...Silver & Bullion Live prices, News, Gold Price India, Gold Online tips, trade gold & silver currency, Forex charts, Top Tips To Buying Gold Jewelry, Golden tips on...

Related Video with forex gold

forex gold Video 1

forex gold Video 2

forex gold Video 3

0 개의 댓글:

댓글 쓰기